- Home

- ATM & Branches

- About Us

- Help Center

- Learn More

-

- Accessibility

-

br

Personal

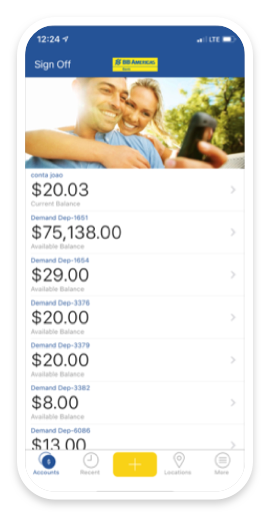

Mobile Banking¹

Bank anytime, anywhere.

Enjoy BB Americas Bank Personal Mobile App features and make your daily banking experience easier.

With BB Americas Mobile App you can:

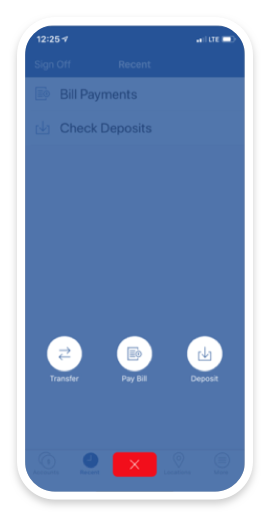

Pay Bills using Bill Pay³

Pay and manage your bills with just a few clicks, by using the BB Americas Bank free online bill payment solution.

Here’s how you begin: First, Enroll in Personal Online Banking. Then, Download the App.

Before you can access the BB Americas Mobile App, you will need to enroll in Personal Online Banking and establish a permanent password.

Once this is completed, you may proceed to download our Mobile App.

If you haven’t enrolled in Personal Online Banking yet, watch our tutorial.

How to download and access the BB Americas Business Mobile App:

For instructions on how to download and access the BB Americas Bank Personal Mobile App, watch the video tutorial or view our step-by-step guide.

Before you download our app, here are some important tips to assist you:

1. Apple App Store

Our Mobile Banking App is available in the Apple App Store. To download the app click on the icon above or visit the Apple App Store and search for the app name in full quotes: “BB Americas Bank”.

2. Google Play Store

Our Mobile Banking App is available in the Google Play Store. To download the app click on the icon above or visit the Google Play Store and search for the app name in full quotes: “BB Americas Bank”.

3. Verification Code Authentication

For security reasons, in some of your first accesses, you will be asked to verify your login credentials by receiving a “Verification Code”. To learn more about “Verification Code Authentication”, click here.

4. Touch ID and Face ID Availability

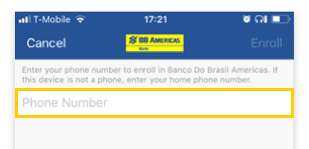

Once you receive the Verification Code sent to your mobile phone, you will be prompted to enter a phone number to enroll for Mobile Banking. This number will be used to enable the Text Banking Service. The Text Banking service is only available for USA phone numbers.

5. Registering your Mobile Number

Once you receive the Verification code sent to your mobile phone, you will be prompted to enter a phone number to enroll for Mobile Banking. This number will be used to enable the Text Banking Service. The Text Banking service is only available for USA phone numbers.

6. Registering your International Mobile Number

If you do not have a USA phone number, you may provide an international (non-USA) phone number to complete the Mobile Banking Enrollment. When registering an international (non-USA) phone number, enter Area Code + the last 8 digits of your cell phone number: for phone number (27) 99871-9307, enter 2798719307. This step is required.

Note:

Verification Code Authentication may occur when:

- You are traveling outside of your previously profiled geographic region;

- You obtain a new device;

- Periodically on a random basis to ensure continued security for the user.

Input of Incorrect Verification Code:

You have up to three attempts to enter the correct Verification Code when prompted. At the fourth attempt, you will be locked out and required to wait 24 hours to attempt to log in again. This is an automatic lockout and the Bank does not have the authority to unlock your access.

Incorrect Password:

Your password is blocked after three attempts. If your password is blocked, you may reset it by accessing the Online Banking environment.

Sprint Users:

Sprint users not receiving a “Verification Code” on their phone, proceed to text “Allow 32858” to “9999”. This will allow you to receive texts without an issue.

T-Mobile Users:

If you are unable to receive the “Verification Code” on your phone, proceed to contact T-Mobile and request that “Short Code” be unblocked.

¹Mobile Banking: To access the BB Americas Bank Mobile App you must have a smartphone with access to an app store. Mobile messages and data rates may apply.

²Mobile Check Deposit: Customer must be enrolled in BB Americas Bank Online Banking. Maximum deposit dollar limit of $5,000.00 within a 5 business day period. If the total sum of multiple mobile check deposits within 5 business days exceeds the allowed deposit maximum of $5,000.00, exceeding amount will be made available in increments of up to $5,000.00 every 5 business days.

Total deposit will be made available on the next business day after the day of deposit, if made prior to the cut-off time. The bank’s cut-off time is 4:00 p.m. EST. Deposits made on a weekend, federal holidays or after the 4:00 pm EST cut-off time will be processed on the following business day. Mobile deposit is only available on iPhone or Android mobile devices with picture capabilities. Mobile message and data rates may apply. Please speak to a BB Americas Bank representative and/or refer to BB Americas Mobile Banking Terms and Conditions for more information.

³Online Bill Pay: Some restrictions may apply. Bill Pay service is only available to clients who have a U.S. address listed on the account. Bill Pay may only be used for payments made to consumers and/or businesses located in the U.S..